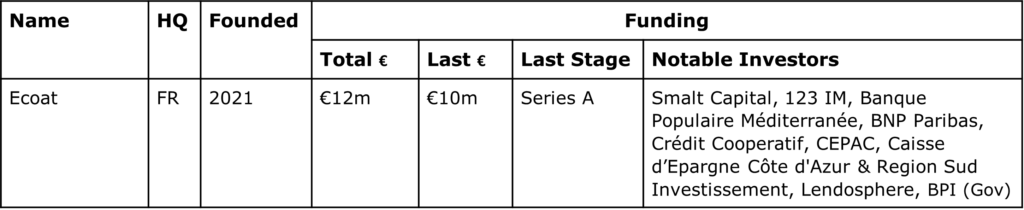

The global paint & coatings market (usually divided into cleaning & pretreatment, paint, and equipment vendors) is valued at $184bn (60% accrues to the industrial sector) & projected to reach $212bn by 2026 (for comparison – or to give away my true nature – that’s about as large as the global video games market). So, in comes France-based Ecoat, which develops, manufactures & sells bio-based/ solvent-free “binders” to paint & coating manufacturers. Its binders can make formulations a) chemical resistant e.g. anti-corrosion/ water repellent, b) fast drying/ drier free/ quickly recoatable – based on its proprietary “Leaf Tech” technology, c) low tack, d) low yellowing, e) low VOC & odorless – based on its proprietary “Clean’R” technology. Ecoat does so under 4 brand names, mainly for use in architectural & wood paints and coatings: i) Solkem – thixotropic range, ii) Inokem – conventional alkyd range, iii) Inokem UR – same as Inokem, but using a water-based polyurethane modified alkyd (69% bio content), iv) Secoia – water-based (85% bio content). Founded in 2011 by Olivier Choulet (CEO), Ecoat employs ~30 people at its headquarters in Grasse, with a production facility in Roussillon (in partnership with OSIRIS – France’s largest chemistry center of excellence/ cluster). Ecoat has received multiple accolades for its innovations, including two Pierre Potier awards. Ecoat now sells its binders on 5 continents & has shown “exponential growth” (not least because the industry is trying to get away from fossil resources; in 2022, Ecoat claims to have avoided 600T of CO2 emissions – for good measure, that’s equivalent to what 10,000 sqm2 of photovoltaics could achieve in a year). The firm says it will use the new funds to 2x its production capacity to 10,000T/ year, by creating 1 new production line & fully automating its 3 existing lines. Ensuing, Ecoat plans to “raise a Series B soon”. <Source: siliconcanals.com, pfonline.com, cfnews.net, 123-im.com, infonet.fr, webtimemedias.com>